The Annual Ritual of Being Wrong

It’s that time of year again. The market pundits—excuse me, strategists—are rolling out their forecasts for 2026.

Here is mine: The market will open and close all year long.

Before we hand out awards for the best and worst 2025 predictions (which is exactly what they are: predictions), stop and think about how ridiculous it is to give these numbers any weight in your investment decisions.

How in the world can anyone know if the productivity boost from AI will offset a falling dollar? Or how Fed tightening, mixed with geopolitical conflict and a global pandemic, will interact with... e-cigarette sales?

Honestly, even if you gave me a cheat sheet of every major news event that actually happened in 2025 in advance, I still couldn’t tell you what the S&P 500 would do.

There is simply too much sentiment involved in the short term. It is impossible to predict what investors will pay for stocks next week or next month. Over the long term? Sure, that's easier. But short-term price targets are guessing games.

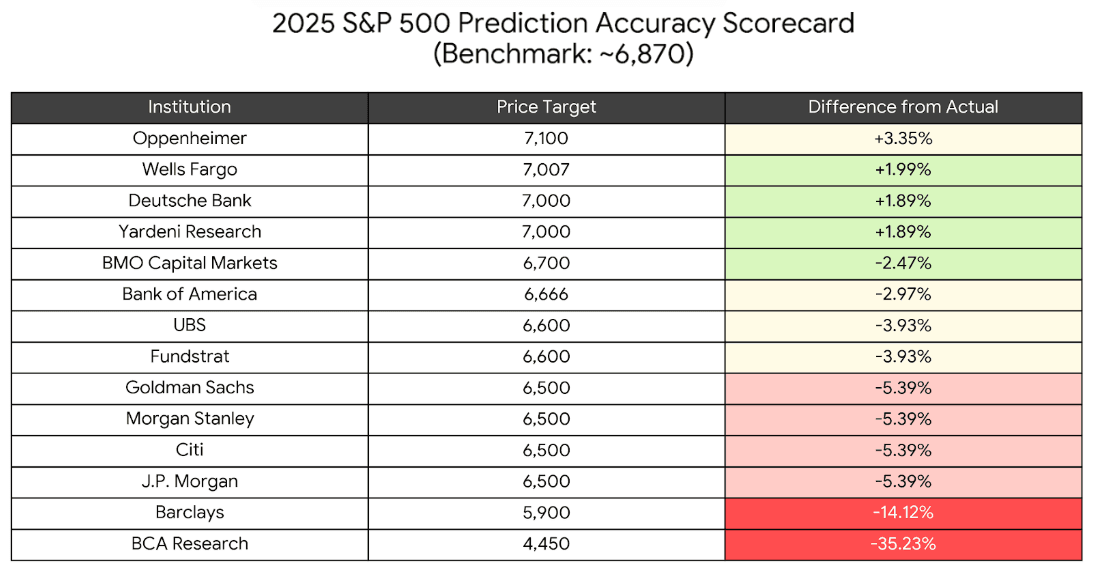

Without further ado, the 2025 Scorecard:

The "Closest Pure Luck Guess" Trophy: Goes to Oppenheimer. They overshot by 3.35%. In fairness, there are still a few trading days left, so this could change.

The "Toilet Bowl" for Most Inaccurate Guess: Goes to BCA Research. They assumed a massive market decline which, well, didn’t happen.

The Psychology of the Guess

Historically, strategists tend to guess too low. Maybe it’s the "underpromise, overdeliver" philosophy. But think about the implication of that.

If you take their predictions as gospel, you will almost always position yourself too conservatively. Their guesses tend to hug the "safe" middle, often coming in below historical market averages.

The salt in the wound is that nobody gets the big bear market years right. Why? Because the real risk is the risk you can’t see.

So, you end up in the worst of both worlds: You are nervous when you shouldn’t be, and when things actually get nasty, you don't see it coming because the experts didn't predict it. Helpful, right?

The Reality of "Normal"

Remember, the standard deviation of the S&P 500 is roughly 20. This means if the market average is 10%, a "normal" distribution is anywhere between -10% to +30%.

That is a normal range of returns!

I’m not going to bother with price targets for next year. If the one-year return of the stock market matters materially to your financial situation, you aren’t positioned properly.

Stocks are long-term instruments. They are going to go haywire sometimes—in both directions. You have to possess the ability to let time in the market do its thing. If you don’t have the luxury of time, you shouldn't own stocks.