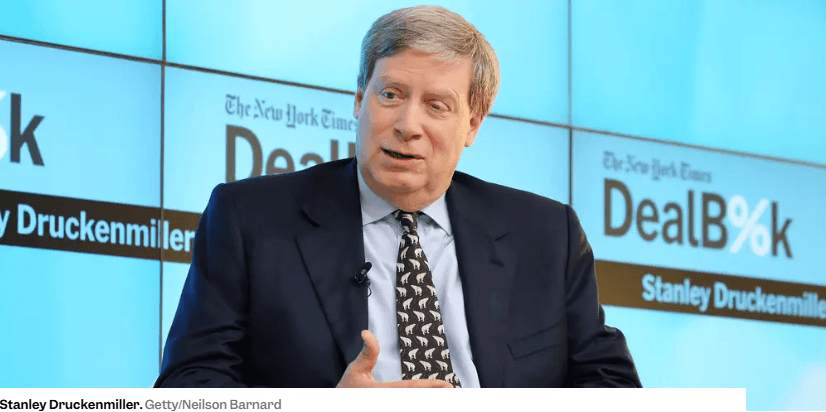

Stan the Man

Stanley Druckenmiller is on the Mount Rushmore of all-time investors. You could argue he’s the goat. He might be mine.

He’s completely discretionary. He’s not a long term value investor like Warren Buffett or the King of Quants like Jim Simons. He identifies an opportunity and allocates aggressively. His fun Duquesne Capital Management reported an average annual rate of return of 30% over 30 years (1981 to 2010) and zero down years. He only had 5 down quarters. Goat.

He was a macro investor searching for his most highly convicted opportunities. Stocks, bonds, commodities, currencies, you name it. The man hates diversification. He called it a “hedge against ignorance.” He declared his secret wasn’t being right so often, but it was being right in large size and cutting losses almost instantly when he was wrong. Incredibly hard to do in practice.

His philosophy was concentration. He made a billion dollars in a day shorting the British pound in 1992. Like how do you get that convicted about anything? Stones.

I have zero criticism for a guy like Stan, but I do think most people should exercise a little caution in adopting his strategy. One of my all-time favorite golf shots was Tiger Woods hitting a high draw 3-iron out of the bunker with the ball below his feet at the 2002 PGA Championship at Hazeltine. That’s the level of difficulty and commitment we are talking about. Not human.

I do think some things can be applied. Stan was big on asymmetric outcomes. If he was right, he was right big. If he was wrong, he was wrong small. He could structure that outcome using leverage. Probably not the greatest advice to most people.

He ran a Two Buckets Strategy. Bucket One was small, long-term investments. If they are right, they explode to the upside. If they go to zero, the positions were small enough not to hurt. Maybe that is the current AI theme. Bitcoin certainly could fall in this category. Bucket Two was the Kill Bucket. He stayed highly liquid for an asymmetric opportunity to emerge, then deployed aggressively. He exercised tremendous patience waiting for these to emerge and didn’t tie up his capital in positions he didn’t believe in. That’s the takeaway. Know what you own and why you own it. If you aren’t convicted, wait. When you are, make it worth your while.